Life insurance, as you know, provides valuable death benefit protection. What you need to understand is that life insurance provides an added value when used as a supplemental retirement tool.

Life Insurance in Retirement Planning

A PROPERLY DESIGNED LIFE INSURANCE POLICY CAN PROVIDE:

Income tax-free death benefit protection

Tax advantaged cash value growth potential

Supplemental retirement cash flow, through tax advantaged withdrawals and/or loans

Where does Cash Value Life Insurance fit?

Clients who need a retirement vehicle with downside protection

High income individuals looking to minimize taxation on earnings

For those who have maximized funding on qualified/non-qualified plans

An Insurance Solution

Death benefit protection during the accumulation years

Accessible cash value during retirement years

Life insurance becomes an income producing asset in the retirement portfolio

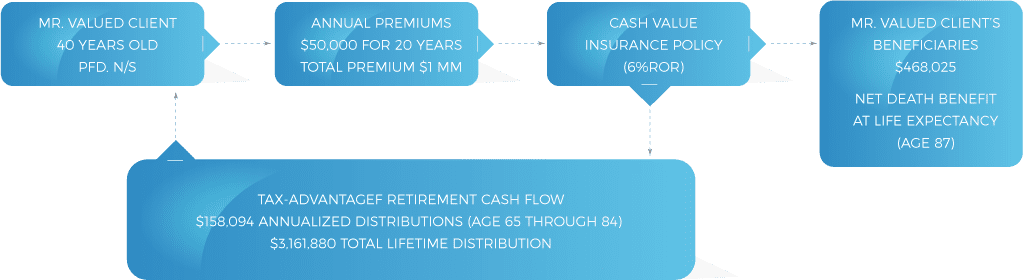

How it Works

Apply for a permanent life insurance policy using Indexed Universal Life (IUL) or Variable Universal Life (VUL)

Based on cash value performance, the policy will grow on a tax-deferred basis

Distributions can be withdrawn/loaned for any purpose

Additional Benefits Created

Provide additional income to pay for your child’s college expenses

Help supplement a gap in retirement before social security begins

Create a steady cash flow after life expectancy once all other assets have been depleted

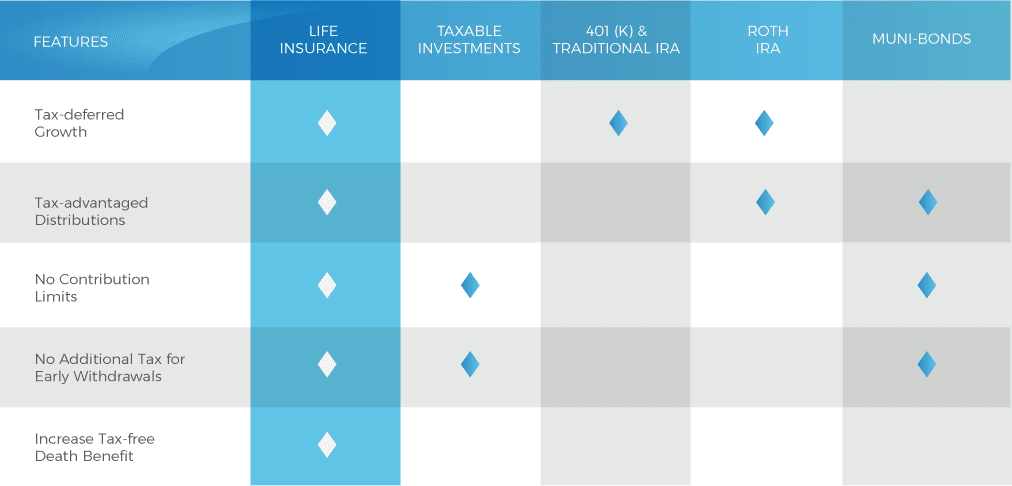

Listed below are the advantages of using cash value life insurance in everyday retirement planning

This presentation presents an overview of estate planning. It is not intended to provide full disclosure. It is not intended to give tax or legal advice. Any comments about tax treatment simply reflect an understanding of current interpretations of tax laws as they relate to estate planning and life insurance. Tax laws are always subject to interpretation and possible changes in the future. It is recommended that you seek the counsel of your attorney, accountant, or other qualified tax advisor regarding estate and life insurance taxation as it applies to your particular situation. These pages depict certain estate planning options. This presentation simply shows the effect that the demonstrated option(s) may have on your estate and potential estate taxes, based on certain assumptions of the value, growth, and disposition of your estate, detailed in the presentation and provided by you. All references to the present or future value of death benefits and cash values of pre-existing life insurance policies are based on the information you have provided for purposes of this analysis. They should not be construed to be the actual present or future values of the death benefits or cash values available in those life insurance policies. For a detailed projection of policy values of a given life insurance policy, please contact the company that issued the policy(ies) in question.